do you have to pay sales tax when selling a used car

Sales and Use Tax. If a vehicle is purchased from an Indiana dealership the dealer.

Understanding Taxes When Buying And Selling A Car Cargurus

If I Sell My Car Do I Have to Pay Taxes.

. The buyer is responsible for paying the sales tax. Additionally if you buy a used car instead of a new one you must still pay a sales tax. Toyota of Naperville says these county taxes are far.

But the options might not work for you. If youre a buyer transferee or user who has title to or has a motor vehicle or trailer youre responsible for paying sales or use tax. Income Tax Implications for Selling a Used Car.

You do not need to pay sales tax when you are selling the vehicle. Thankfully the solution to this dilemma is pretty simple. If for example you and.

Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. In short yes you do have to pay sales tax on the purchase of a used car. When you donate a car instead of.

If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. How do I avoid sales tax on a car. If you sell your car for more than you originally paid for it you will owe capital gains tax.

First theres always the option to buy a car in another state to avoid sales tax. Is it Possible Not to Pay Any Sales Tax on Used Cars. But if you buy privately from an individual you will need to pay the sales tax yourself when you register the vehicle as yours.

Do you have to pay sales tax when you buy a used car. So if your used vehicle costs 20000. However you do not pay that tax to the car dealer or individual selling the.

When you purchase a vehicle in Indiana you must pay sales tax on the purchase price of the vehicle. If your trade-in is valued at 4000 and the new car is valued at 22000 youll only pay sales tax on the difference18000 in this case. Prove that sales tax was paid.

To calculate how much sales tax youll owe simply. You will register the vehicle in a state. Motor vehicle or trailer.

625 sales or use tax. Many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. You do not need to pay the tax to.

Prove your vehicle registration is exempt from sales tax. When you register a vehicle in New York at a DMV office you must either. In fact a new vehicle is.

For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. That means youll be taxed only on 20000 instead of being taxed on 45000. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include.

Pay the sales tax. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Used car dealerships will include this in the total cost of the vehicle.

Vehicle Sales Tax Deduction H R Block

Arkansas Sales Tax On Used Vehicles Trailers And Semitrailers Priced Between 4 000 10 000 Now 3 5

Do You Pay Sales Tax On A Lease Buyout Bankrate

Nj Car Sales Tax Everything You Need To Know

Selling To A Dealer Taxes And Other Considerations News Cars Com

Do Car Owners Pay Taxes On The Proceeds Of A Car Sale

/cloudfront-us-east-1.images.arcpublishing.com/gray/IL4UIY7BSZCWXDWOWVTE6RNZSI.jpg)

Used Car Sales To Change In Texas

If I Sell My Car Do I Pay Taxes All You Need To Know About Taxes When Selling A Vehicle

Sell Your Car Used Car Buyer In Florida Car Geeks

Sales Taxes In The United States Wikipedia

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Taxes When Buying Or Selling Cars At Thompson Sales

502 Bad Gateway4 Reasons To Use Your Tax Return To Buy A Car Legend Auto Sales Blog

How To Purchase A Used Car With Cash Yourmechanic Advice

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

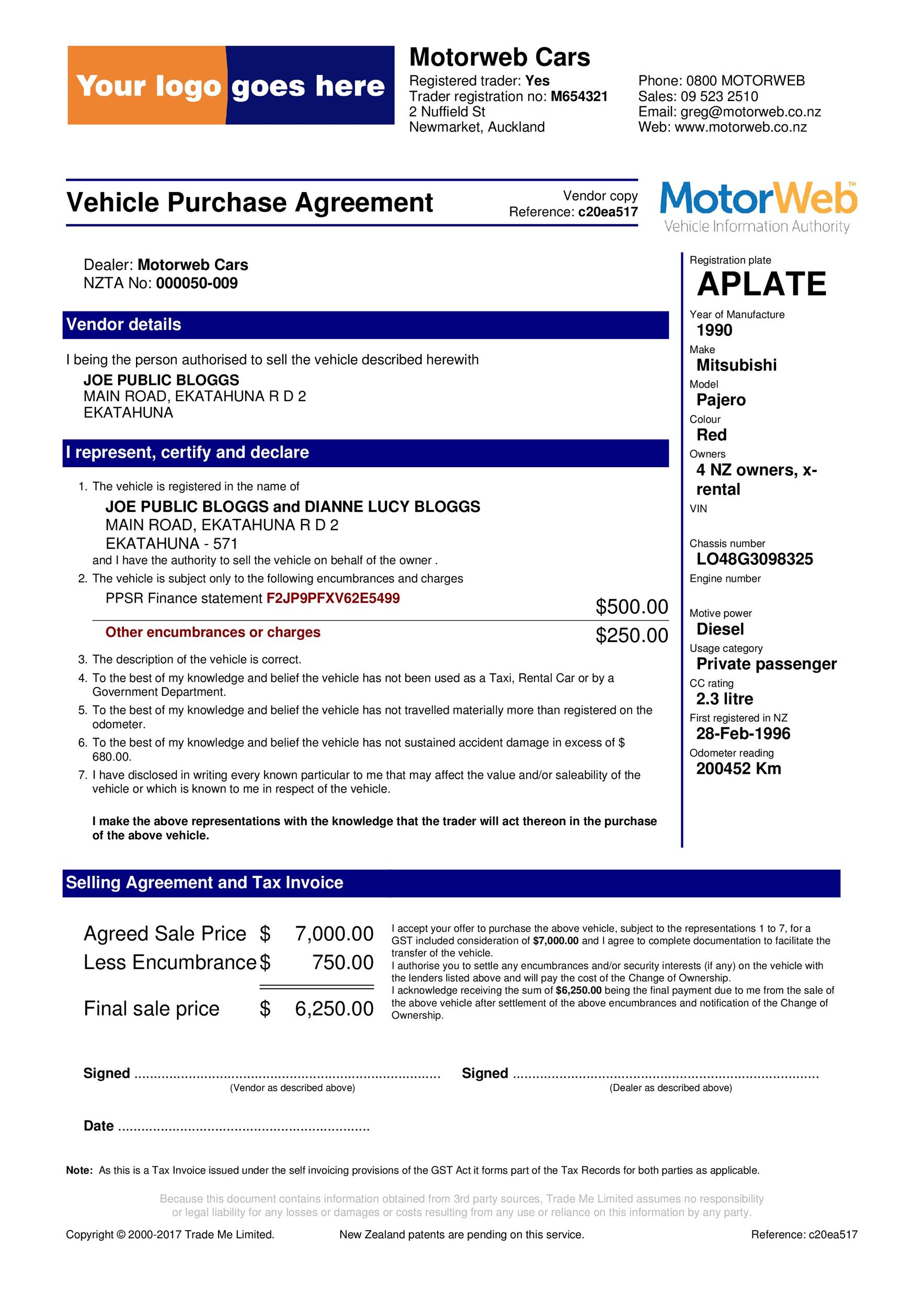

42 Printable Vehicle Purchase Agreement Templates ᐅ Templatelab